Gehen Sie über zu

Dezentralisierte Finanzen

Lead your Company into:

Lead your Company into:

We advise private, corporate, and institutional clients in strategically accessing Decentralized Finance, Web3 & AI infrastructure – from yield-generating protocols to token-based business models and AI technology solutions.

Through tailored executive advisory and institutional-grade consulting, we combine actionable frameworks with real-world execution to help you grow, adapt, and lead in the next financial & technical paradigm.

We advise private, corporate, and institutional clients in strategically accessing Decentralized Finance and Web3 infrastructure – from yield-generating protocols to token-based business models.

Through tailored coaching, executive advisory, and institutional-grade consulting, we combine actionable frameworks with real-world execution to help you grow, adapt, and lead in the next financial paradigm.

In a world where traditional finance is being disrupted, Decentralized Finance (DeFi) unlocks unprecedented opportunities for yield, autonomy, and innovation.

At BOGNER, we empower corporate leaders and institutional allocators to strategically access the evolving world of DeFi and Web3. Whether you're aiming to outperform benchmarks with structured yield strategies, implement tokenized business models, or guide your organization into the decentralized economy — we deliver the insight and infrastructure to make it happen.

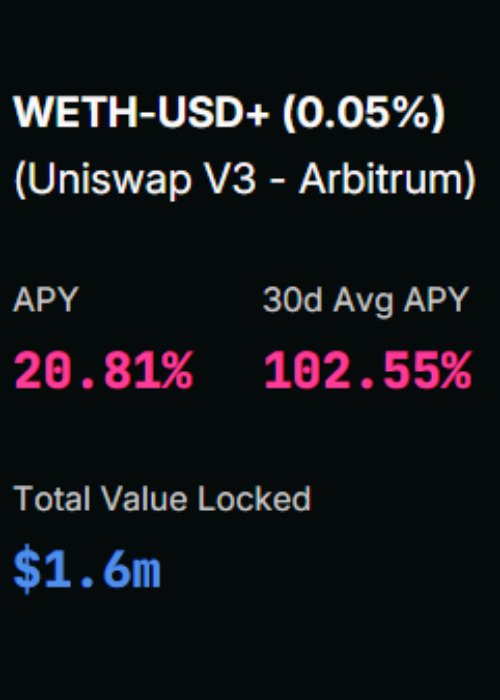

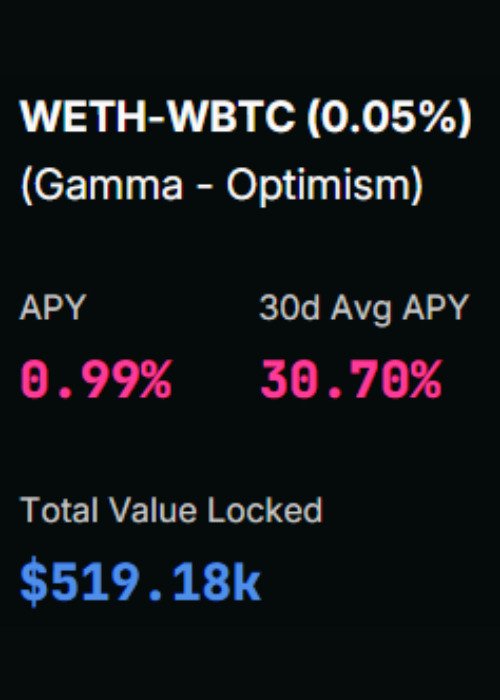

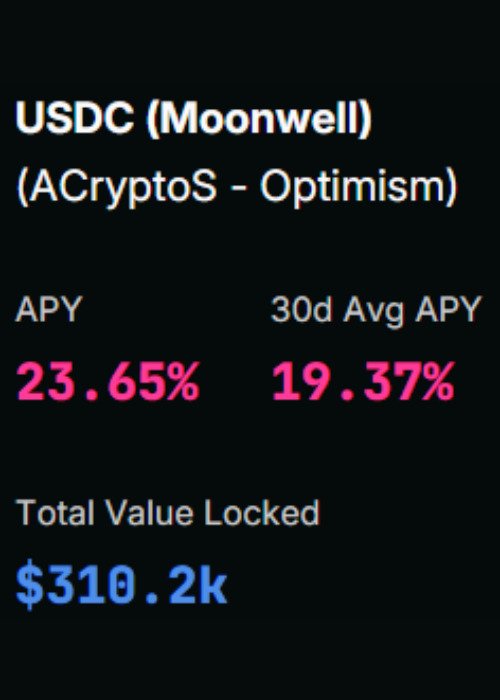

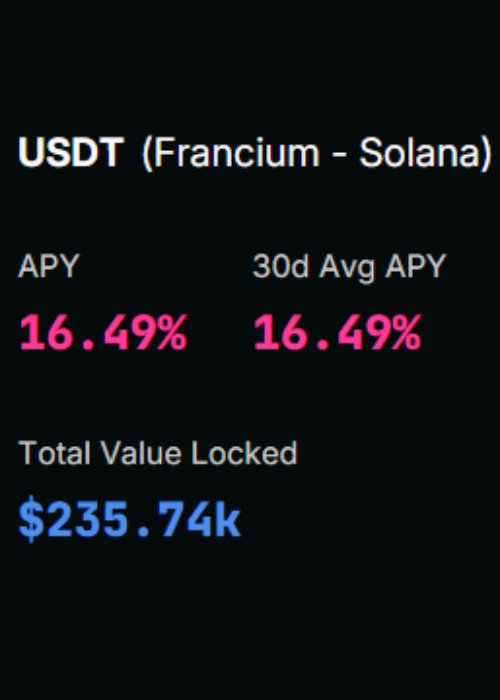

For qualified investors and funds, we provide institutional-grade DeFi strategies, including custom-built trading systems and AI-driven alpha generation tools.

In a world where traditional finance is being disrupted, Decentralized Finance (DeFi) unlocks unprecedented opportunities for yield, autonomy, and innovation.

Whether you're aiming to outperform benchmarks with structured yield strategies, implement tokenized business models, or guide your organization into the decentralized economy — BOGNER delivers the insight and infrastructure to make it happen.

For qualified investors and funds, we provide institutional-grade DeFi strategies, including custom-built trading systems and AI-driven alpha generation tools.

In a world where traditional finance is being disrupted, Decentralized Finance (DeFi) unlocks unprecedented opportunities for yield, autonomy, and innovation.

At BOGNER, we empower corporate leaders and institutional allocators to strategically access the evolving world of DeFi and Web3. Whether you're aiming to outperform benchmarks with structured yield strategies, implement tokenized business models, or guide your organization into the decentralized economy — we deliver the insight and infrastructure to make it happen.

For qualified investors and funds, we provide institutional-grade DeFi strategies, including custom-built trading systems and AI-driven alpha generation tools.

Strategic guidance for forward-thinking leadership.

We advise executives and board members on integrating Web3 technologies into business strategy, from token models, corporate NFTs to decentralized governance.

Unlock new business models with decentralized innovation.

We support companies in identifying and implementing Web3 use cases — including tokenization, smart contract infrastructure, NFTs and decentralized finance integrations — to create scalable, future-proof business solutions.

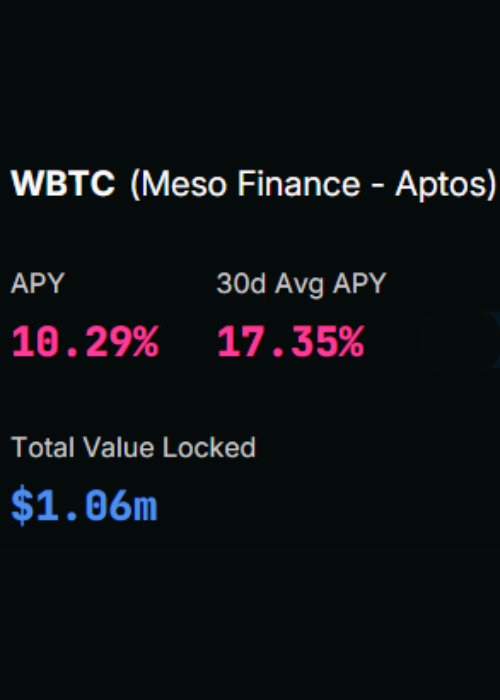

Institutional-grade access to decentralized finance.

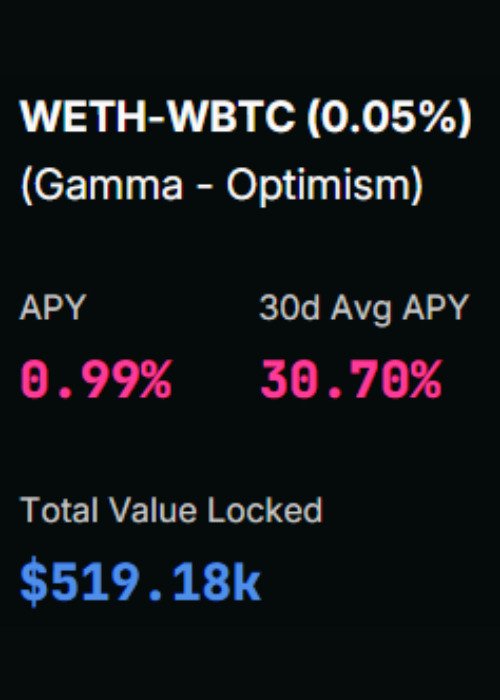

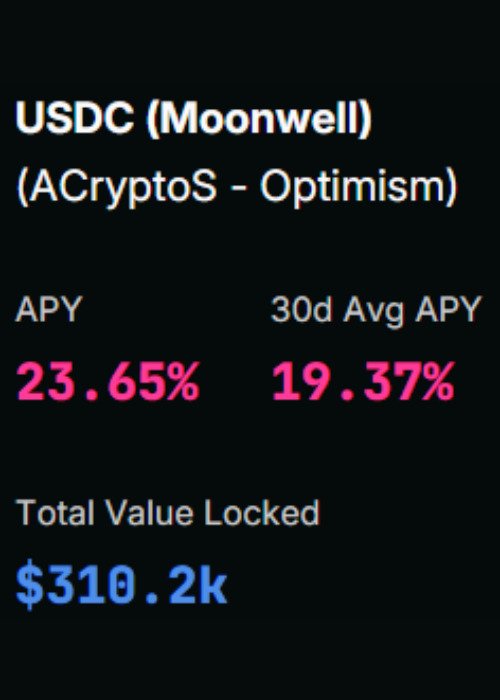

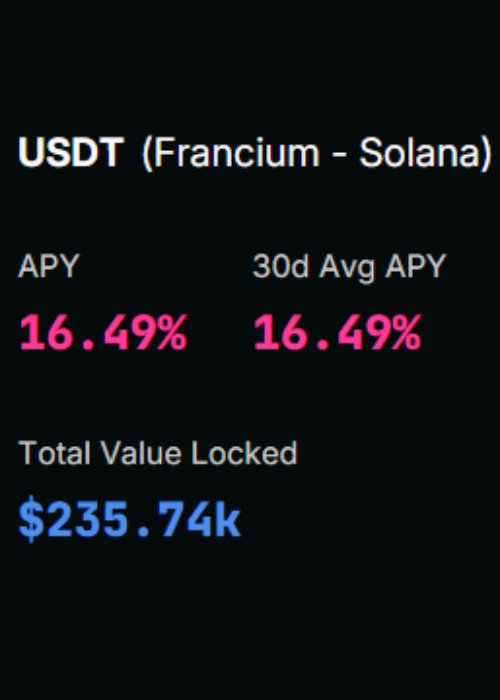

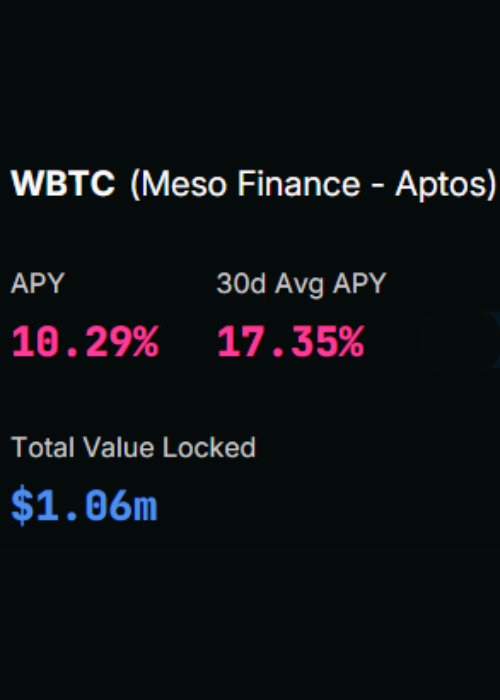

We guide institutional investors and asset managers in building structured DeFi portfolios, from fixed income to high-yield strategies — supported by due diligence, risk frameworks, and execution infrastructure.

BOGNER develops fully customized, AI-driven trading systems for individual and institutional investors operating in the Web3 and DeFi space. From dynamic crypto portfolio management to precision-engineered execution layers, we provide end-to-end automation that adapts in real-time to fast-moving markets.

By integrating large language models (LLMs), on-chain analytics, and TradingView-based execution logic, our systems deliver scalable alpha strategies across decentralized and centralized platforms.

MAI 02, 2023

MAI 02, 2023

SEP 16, 2023

SEP 16, 2023

OCT 4, 2023

OCT 4, 2023

#Mam beliebtesten

#Mam beliebtesten

Praxiserfahrungen

Gegründet am

Praxiserfahrungen

Reaktionszeit

High Land Street Area, 22. Stock

New York, NY 12007

Vereinigte Staaten

ST Bernard Street Area, 08. Stock

Edinburgh, EB 20018

Vereinigtes Königreich

Melanise Street Area, 24. Stock

Sydney, SY 34031

Australien